However the loan also is due if the customer sells the home or moves to another house and leas the house that is the security for the reverse home mortgage. Typically the house is sold and the sale earnings are used to pay the reverse home mortgage. But if the property owner or the property owner's heirs have adequate funds, they can use those funds to pay the reverse home mortgage and keep the home.

When the loan balance is more than the sale earnings of the house, the federal government compensates the lender for the difference. The homeowner's estate Look at more info and beneficiaries do not need to make up the distinction, when the loan was federally insured. It's likely that the heirs or estate of the property owner will get little or no equity from the sale of the house in many cases.

The administrator and the heirs likewise need to be informed if the reverse mortgage is federally-insured so they will understand the loan provider can't look for from them anything beyond the sale earnings of the house. When the sale continues exceed You can find out more the impressive loan balance, the estate or the beneficiaries receive the excess quantity.

The loan earnings can be used for any costs however usually are utilized to pay for monthly living costs, house repair and maintenance, or long-lasting care supplied in the house. The debtor's credit value does not matter, since the house equity backs the loan. The customer just requires to reveal that his/her earnings suffices to pay the home's taxes and insurance and keep the https://blogfreely.net/regais21pe/you-and-39-d-discover-yourself-in-a-position-where-you-need-to-pay-back-the-loan home.

What Do Mortgages Lenders Look At Things To Know Before You Get This

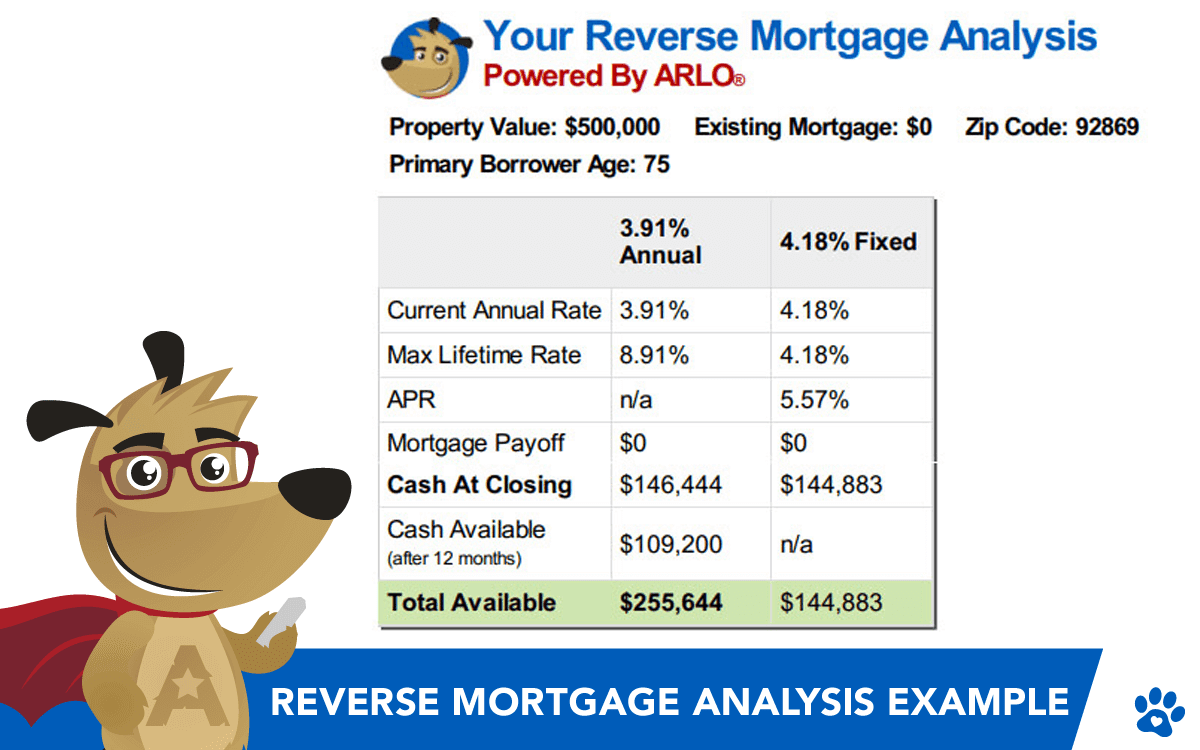

This makes reverse home loans a luring choice for elders who do not get approved for a conventional house equity loan or can not make regular monthly payments. Potential borrowers ought to understand that there are costs and charges for securing a reverse home mortgage, and these usually total up to 1% to 4% of the amount of the loan.

It is necessary to look around amongst loan providers before choosing a reverse home loan. The terms of reverse home loans can differ significantly among lenders. You may wind up with considerably more cash by utilizing one lender rather of another. In next week's concern of Retirement Watch Weekly, I'll explain the different types of reverse mortgages and the benefits and issues of each one.

That's why the results of my year-long examination are so essential for every single AMERICAN to get a deal with on. Click here now to read my new findings and protect yourself from the monetary devastation can be found in 2021.

A reverse mortgage works extremely in a different way from a standard home mortgage: Rather of paying to your lender, your loan provider pays to you. A reverse home loan gives homeowners age 62 or older a versatile way to access their house's equity as their living needs change. A reverse mortgage is a customized home mortgage that allows homeowners who are 62 or older to transform their home equity into money.

Top Guidelines Of What Happens To Mortgages In Economic Collapse

Over time, your loan balance grows and your equity shrinks. With a conventional mortgage, however, you minimize your balance with each payment and your equity increases for many years. The most common kind of reverse home mortgage is a Home Equity Conversion Mortgage (HECM) backed by the Federal Real Estate Administration (FHA).

For the functions of this short article, we'll concentrate on HECMs. A reverse mortgage provides you access to your house's equity as you age. why do mortgage companies sell mortgages. Reverse home mortgage requirements are likewise different from those of a forward mortgage. Here's a rundown of how a reverse mortgage works: The older you are when you take out your reverse mortgage, the more equity you have access to.

Older customers on fixed earnings eliminate the expense of a monthly mortgage payment. You will not go through the debt-to-income (DTI) ratio or credit rating requirements of routine home loans. However, you need to pay ongoing expenses like property taxes, house owners insurance coverage and maintenance, or you might run the risk of losing your house to foreclosure - what is a hud statement with mortgages.

However, the interest isn't tax-deductible till you sell the home or settle the reverse mortgage. Reverse home mortgages were produced to allow seniors to "age in place." If you do not live there full-time or require to move into an assisted living facility, the lending institution might foreclose. The FHA requires that you fulfill with a HUD-certified counselor to guarantee you comprehend all of the benefits and downsides of reverse home loans.

What Is The Interest Rate For Mortgages Today Fundamentals Explained

Reverse mortgage guidelines restrict how much equity you can obtain, so it's not likely you'll wind up underwater. However, if you do, home mortgage insurance coverage will cover any loan balance higher than the home's value. A few of the disadvantages of reverse home loans are pricey fees. Reverse home loan lending institutions can charge up to $6,000 for origination fees, and the in advance mortgage insurance premiums of 2% of the home's worth are greater than most forward mortgages.

You can select from one or a mix of numerous payment choices to gain access to house equity with a reverse home mortgage. Reverse home mortgage rate of interest are normally adjustable rates, which suggests they may rise or fall over time, which can diminish your equity faster in a rising-rate environment. This choice involves one big payment after your reverse loan closes.

Also called the "period" option, you can pick routine month-to-month payments for as long as you or a co-borrower lives in the house as your primary residence If you simply need extra income for a couple of years, this choice permits you to choose the number of months you'll get routine month-to-month payments.

You can access the line as needed till you've consumed the offered balance. You can choose a combination of monthly payments and a credit line while you or a co-borrowing partner are still living in your home. A mix of the line of credit, which can be added for extra funds in case you need more money, and term payments.

What Is Required Down Payment On Mortgages - Questions

HECMs are guaranteed by the FHA. There are no limits on what HECM funds can be utilized for. Some state and city government agencies may provide these types of reverse mortgages, but the funds can only be used to satisfy particular requirements such as repairing a house or paying past-due property taxes.

Personal business might offer their own reverse home mortgages at loan amounts higher than HECM loan limits. You might also have the ability to get a bigger preliminary advance from an exclusive reverse mortgage, but these loans also will not have the federal backing from the FHA and could be more expensive. Pros You'll have more options to use your house equity as your needs change You can supplement a part of your retirement earnings You can use the reverse home mortgage funds as you desire You will not leave a monetary concern to your heirs Your qualified non-borrowing spouse can remain in the home after you pass away or vacate You might decrease your month-to-month housing expenses Cons Your loan could be foreclosed if you do not live in the house complete time Your loan balance increases gradually Your equity drops over time You may reduce the quantity you're eligible to get for other advantages You're minimizing the inheritance worth of your home You'll pay more for reverse home mortgage closing costs Financial abuse of senior citizens has ended up being a multibillion-dollar problem in the United States.