If your credit report consists of negative info that is accurate, but there are great factors for trusting you to repay a loan, be sure to discuss your circumstance to the lender or broker. If your credit problems can not be discussed, you will most likely need to pay more than customers who have excellent credit rating.

Ask how your past credit history affects the rate of your loan and what you would require to do to get a much better price. Put in the time to look around and work out the best deal that you can. Whether you have credit issues or not, it's a good idea to examine your credit report for precision and completeness prior to you request a loan.

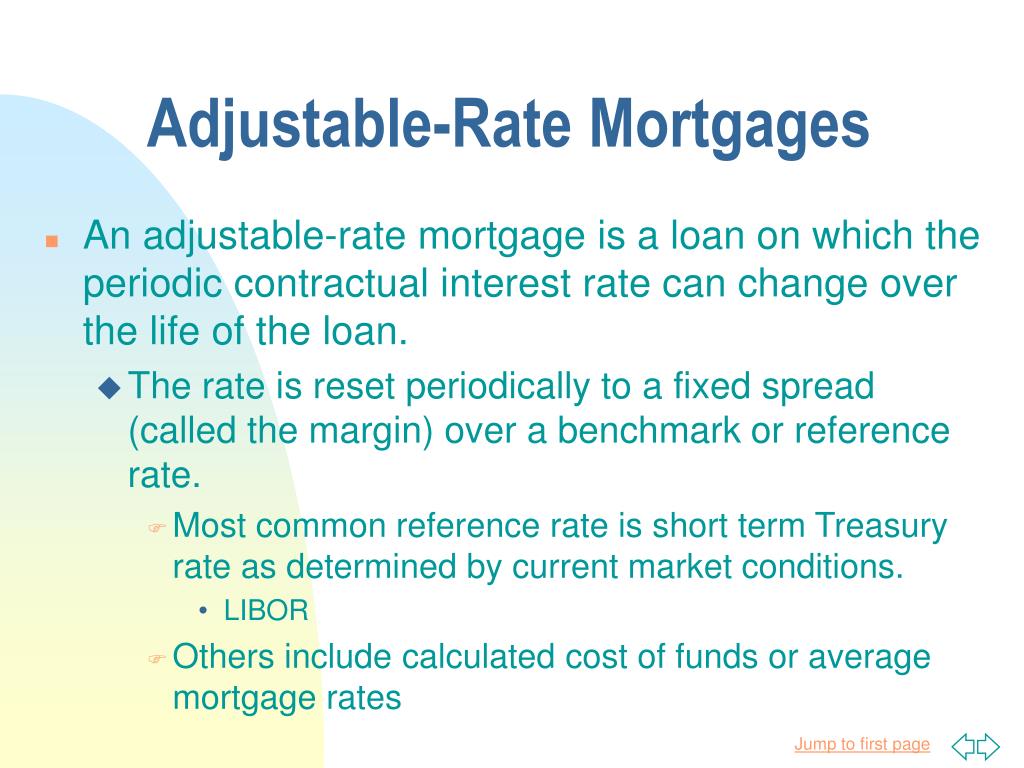

annualcreditreport.com or call (877) 322-8228. A home loan that does not have a fixed interest rate. The rate modifications during the life of the loan based on motions in an index rate, such as the rate for Treasury securities or the Expense of Funds Index. ARMs generally provide a lower preliminary interest rate than fixed-rate loans.

When rates of interest increase, normally your loan payments increase; when rate of interest reduce, your regular monthly payments may reduce. For additional information on ARMs, see the Consumer Handbook on Adjustable Rate Mortgages. The cost of credit revealed as an annual rate - how do canadian mortgages work. For closed-end credit, such as auto loan or home mortgages, the APR includes the rates of interest, points, broker fees, and particular other credit charges that the customer is required to pay.

Mortgage aside from those insured or guaranteed by a federal government firm such as the FHA (Federal Real Estate Administration), the VA (Veterans Administration), or the Rural Advancement Services (previously called the Farmers Home Administration or FmHA). The holding of money or documents by a neutral 3rd party before closing on a property.

The How Do Negative Interest Rate Mortgages Work Ideas

Loans that typically have repayment terms of 15, 20, or thirty years. Both the rates of interest and the monthly payments (for principal and interest) remain the very same throughout the life of the loan. The price paid for borrowing money, usually stated in portions and as an annual rate. Fees charged by the lending institution for processing a loan; typically revealed as a portion of the loan quantity.

Frequently the contract also specifies the number of points to be paid at closing. A contract, signed by a debtor when a mortgage is made, that provides the loan provider the right to acquire the residential or commercial property if the debtor stops working to pay off, or defaults on, the loan.

Loan officers and brokers are frequently allowed to keep some or all of this difference as extra payment. (also called discount rate points) One point is equal to 1 percent of the principal amount of a mortgage loan. For example, if a home loan is $200,000, one point equals $2,000. Lenders regularly charge points in both fixed-rate and adjustable-rate mortgages to cover loan origination costs or to offer extra compensation to the lender or broker.

In many cases, the cash required to pay points can be obtained, but increases the loan quantity and the total costs. Discount rate points (often called discount rate charges) are points that the borrower voluntarily picks to pay in return for a lower rate of interest. Protects the lending institution against a loss if a customer defaults on the loan.

When you acquire 20 percent equity in your home, PMI https://simonawaf523700.carrd.co/ is cancelled. Depending on the size of your timeshare exchange companies home loan and down payment, these premiums can add $100 to $200 monthly or more to your payments. Costs paid at a loan closing. Might consist of application costs; title examination, abstract of title, title insurance, and home study fees; charges for preparing deeds, mortgages, and settlement files; attorneys' fees; recording charges; estimated expenses of taxes and insurance coverage; and notary, appraisal, and credit report charges.

How Does Chapter 13 Work With Mortgages for Beginners

The good faith quote lists each anticipated cost either as an amount or a range. A term usually describing cost savings banks and savings and loan associations. Board of Governors of the Federal Reserve System Department of Real Estate and Urban Advancement Department of Justice Department of the Treasury Federal Deposit Insurance Corporation Federal Real Estate Financing Board Federal Trade Commission National Credit Union Administration Workplace of Federal Housing Business Oversight Workplace of the Comptroller of the Currency Office of Thrift Supervision These companies (other than the Department of the Treasury) enforce compliance with laws that forbid discrimination in loaning.

As a novice home purchaser, you have an amazing journey ahead. We understand getting your first mortgage and navigating an intricate housing market can be daunting. At U.S. Bank, we want your very first house purchase to Informative post be a satisfying experience and we're here to help first-time house buyers any method we can.

And that's with lending institutions being fussy about their consumers and particular about their requirements. JPMorgan Chase, for example, will make mortgages to brand-new clients only with credit scores of 700 or more (up from 640) and deposits of 20 percent or higher. USAA has momentarily stopped writing jumbo loans, which are mortgages that are usually too large to be backed by the federal government, among other items.

Ms. Smith and her other half, Philip Ellis, had actually wanted to go through a novice property buyer program at Wells Fargo that would need them to put down 3 percent. They even endured a needed instructional course. However two weeks before closing on their $205,000 house, their lending officer stated they required to put down 5 percent to keep their rate.

Smith stated, they learned their loan was for less than what they had actually been preapproved for and they required to come up with an additional $4,000. In the end, their down payment and closing costs exceeded $14,000 about 45 percent more than they had actually expected. The couple, who had actually wed in April, utilized money recovered from their canceled wedding event reception.

The 4-Minute Rule for How Do Equity Release Mortgages Work

Smith stated they were also lucky to have the support of their households, who fed and protected them so they could conserve every cent. But the stability of their jobs was likewise more than likely an essential element." I think our capability to secure the loan was because of us both being teachers and having a contract for employment already for the list below year," she said.

Even under normal circumstances, there are a range of scenarios in which customers might be asked to raise their down payment or obtain a much better rate by doing so, a company representative stated. Some lenders also would like to know more about borrowers' other possible sources of money. When Chris Eberle, an innovation executive, and his partner were securing their jumbo mortgage for a new home in Palo Alto, Calif., their lending institution, a California home loan bank, needed to know not just how much they had in their retirement accounts but how simple it was to get at that cash.